MEDICARE SUPPLEMENTS

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.MEDICARE SUPPLEMENT PLANS

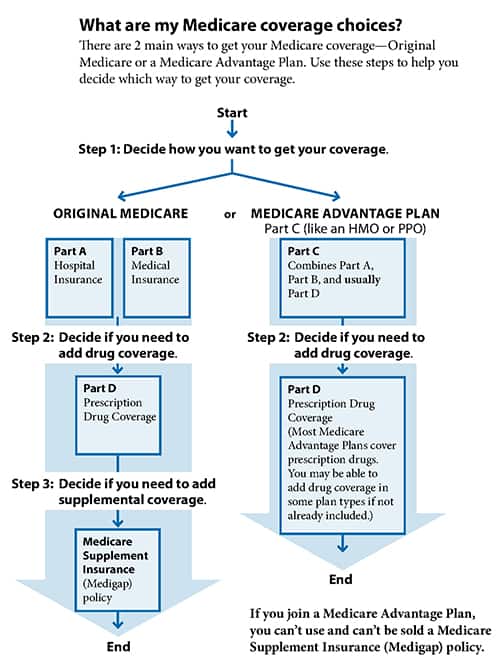

Click on the Headlines Below to Read More Information:What are my Medicare coverage choices?

What are Medicare Supplement Insurance (Medigap) Policies?

Original Medicare pays for many, but not all, health care services and supplies. A Medicare Supplement Insurance policy, sold by private companies, can help pay some of the health care costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles. Medicare Supplement Insurance policies are also called Medigap policies.

Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medigap policy pays its share. You have to pay the premiums for a Medigap policy.

Are Medigap Policies Standardized?

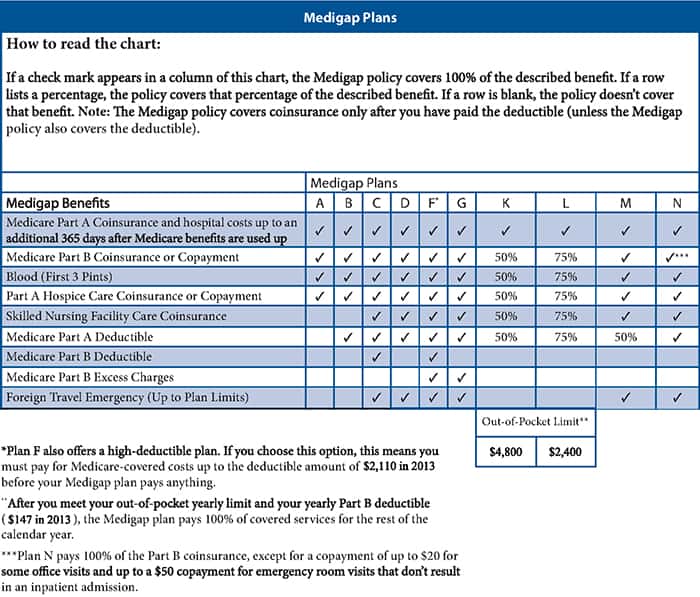

Every Medigap policy must follow federal and state laws designed to protect you and it must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a “standardized” policy identified in most states by letters A–N. All policies offer the same basic benefits, but some offer additional benefits so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Note: Plans E, H, I, and J are no longer available to buy, but if you already have one of those policies, you can keep it. Contact your insurance company for more information.

How do I Compare Medigap Policies?

Different insurance companies may charge different premiums for the same exact policy. As you shop for a policy, be sure you’re comparing the same policy (for example, compare Plan A from one company with Plan A from another company). In some states, you may be able to buy a type of Medigap policy called Medicare SELECT (a policy that requires you to use specific hospitals and, in some cases, specific doctors or other health care providers to get full coverage). If you buy a Medicare SELECT policy, you have the right to change your mind within 12 months and switch to a standard Medigap policy.

Important Facts

- You must have Part A and Part B.

- You pay a monthly premium for your Medigap policy in addition to your monthly Part B premium.

- A Medigap policy only covers one person. Spouses must buy separate policies.

- You can’t have prescription drug coverage in both your Medigap policy and a Medicare drug plan.

- It’s important to compare Medigap policies since the costs can vary and may go up as you get older. Some states limit Medigap premium costs.

When to Buy?

- The best time to buy a Medigap policy is during your Medigap Open Enrollment Period. This 6-month period begins on the first day of the month in which you’re 65 or older and enrolled in Part B. (Some states have additional open enrollment periods.) After this enrollment period, your option to buy a Medigap policy may be limited and it may cost more.

- If you delay enrolling in Part B because you have group health coverage based on your (or your spouse’s) current employment, your Medigap Open Enrollment Period won’t start until you sign up for Part B.

- Federal law doesn’t require insurance companies to sell Medigap policies to people under 65. If you’re under 65, you might not be able to buy the Medigap policy you want, or any Medigap policy, until you turn 65. However, some states require Medigap insurance companies to sell Medigap policies to people under 65.

How Does Medigap Work with Medicare Advantage Plans?

- If you have a Medigap policy and join a Medicare Advantage Plan (like an HMO or PPO), you may want to drop your Medigap policy. Your Medigap policy can’t be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums. If you want to cancel your Medigap policy, contact your insurance company. In most cases, if you drop your Medigap policy to join a Medicare Advantage Plan, you won’t be able to get it back.

- If you have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to Original Medicare. If you want to switch to Original Medicare and buy a Medigap policy, find out what policies are available to you and contact your Medicare Advantage Plan to disenroll. You’ll need to let the Medigap insurer know the date your plan coverage will end. If you don’t intend to leave your Medicare Advantage Plan, and someone tries to sell you a Medigap policy, report it to your State Insurance Department.

- If you join a Medicare Advantage Plan for the first time, and you aren’t happy with the plan, you’ll have special rights to buy a Medigap policy if you return to Original Medicare within 12 months of joining.

- If you had a Medigap policy before you joined, you may be able to get the same policy back if the company still sells it. If it isn’t available, you can buy another Medigap policy.

- If you joined a Medicare Advantage Plan when you were first eligible for Medicare, you can choose from any Medigap policy.

- The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Prescription Drug Plan.

Where Can I Get My Questions Answered?

Definitions

Learn More Today!

Roswell, NM Office: 110 W. Country Club Rd., Suite 5, Roswell, NM 88201

Rio Rancho, NM Office: 1453 Rio Rancho Dr SE, Suite 3, Rio Rancho, NM 87124

Albuquerque, NM Office: 1504 Wyoming Blvd NE, Suite A, Albuquerque, NM 87112

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.

© Med-Care Senior Insurance Solutions - All Rights Reserved