MEDICARE ADVANTAGE

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.MEDICARE ADVANTAGE PLANS

Click on the Headlines Below to Read More Information:Aetna

Amerigroup

BlueCross BlueShield of Arizona

BlueCross BlueShield of Illinois/HCSC

BlueCross BlueShield of Montana/HCSC

BlueCross BlueShield of New Mexico/HCSC

BlueCross BlueShield of Oklahoma/HCSC

BlueCross BlueShield of Texas/HCSC

Bright Health

Care 1st Health Plan

Care Improvement Plus

CareMore

Cigna

Christus

Global Health Plan

Health Choice

Humana

Molina Healthcare

SCAN Health Plan

United Healthcare

The University of Arizona Health Plans

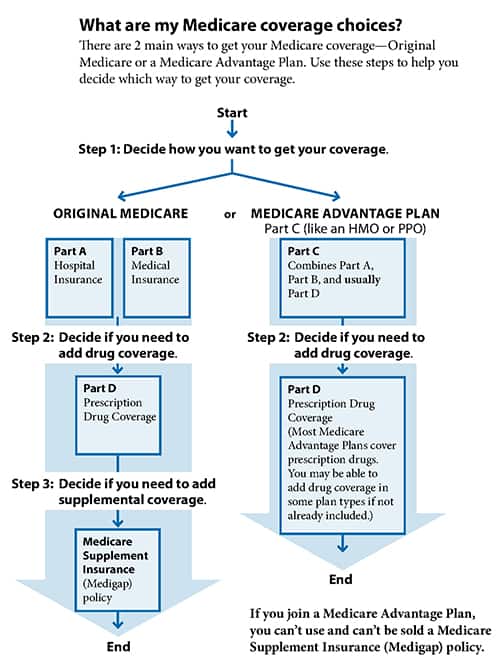

What are my Medicare coverage choices?

What are Medicare Advantage Plans (Part C)?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have Medicare. You’ll get your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage from the Medicare Advantage Plan, not Original Medicare.

Medicare Advantage Plans Cover All Medicare Services

In all types of Medicare Advantage Plans, you’re always covered for emergency and urgent care. Medicare Advantage Plans must cover all of the services that Original Medicare covers except hospice care and some care in qualifying clinical research studies. Original Medicare covers hospice care and some costs for clinical research studies even if you’re in a Medicare Advantage Plan. Medicare Advantage Plans may offer extra coverage, like vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage (Part D). In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan.

Medicare Advantage Plans Must Follow Medicare's Rules

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care). These rules can change each year. The plan must notify you about any changes before the start of the next enrollment year.

Read the information You Get From Your Plan

If you’re in a Medicare plan, review the “Evidence of Coverage” (EOC) and “Annual Notice of Change” (ANOC) your plan sends you each fall. The EOC gives you details about what the plan covers, how much you pay, and more. The ANOC includes any changes in coverage, costs, or service area that will be effective in January. If you don’t get these important documents, contact your plan.

Who can join?

You must meet these conditions to join a Medicare Advantage Plan:

- You have Part A and Part B.

- You live in the plan’s service area.

- You don’t have End-Stage Renal Disease (ESRD)

- You can join a Medicare Advantage Plan even if you have a pre-existing condition, except for End-Stage Renal Disease (ESRD)

- You can only join or leave a plan at certain times during the year.

- Each year, Medicare Advantage Plans can choose to leave Medicare or make changes to the services they cover and what you pay. If the plan decides to stop participating in Medicare, you’ll have to join another Medicare health plan or return to Original Medicare.

- Medicare Advantage Plans must follow certain rules when giving you information about how to join their plan.

Prescription Drug Coverage

You usually get prescription drug coverage (Part D) through the Medicare Advantage Plan. In some types of plans that don’t offer drug coverage, you can join a Medicare Prescription Drug Plan. If your Medicare Advantage Plan includes prescription drug coverage and you join a Medicare Prescription Drug Plan, you’ll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare.

What if I Have Other Coverage?

Talk to your employer, union, or other benefits administrator about their rules before you join a Medicare Advantage Plan. In some cases, joining a Medicare Advantage Plan might cause you to lose employer or union coverage. If you lose coverage for yourself, you may also lose coverage for your spouse and dependants. In other cases, if you join a Medicare Advantage Plan, you may still be able to use your employer or union coverage along with the plan you join. Remember, if you drop your employer or union coverage, you may not be able to get it back.

What if I Have a Medicare Supplement Insurance Policy?

You can’t use (and can’t be sold) a Medicare Supplement Insurance (Medigap) policy while you’re in a Medicare Advantage Plan. You can’t use it to pay for any expenses (copayments, deductibles, and premiums) you have under a Medicare Advantage Plan. If you already have a Medigap policy and join a Medicare Advantage Plan, you’ll probably want to drop your Medigap policy. If you drop your Medigap policy, you may not be able to get it back.

What Do I Pay?

Your out-of-pocket costs in a Medicare Advantage Plan depend on the following:

- Whether the plan charges a monthly premium.

- Whether the plan pays any of your monthly Part B premium.

- Whether the plan has a yearly deductible or any additional deductibles for certain services.

- How much you pay for each visit or service (copayments or coinsurance).

- The type of health care services you need and how often you get them.

- Whether you go to a doctor or supplier who accepts assignment (if you’re in a Preferred Provider Organization, Private Fee-for-Service Plan, or Medical Savings Account Plan and you go out-ofnetwork).

- Whether you follow the plan’s rules, like using network providers.

- Whether you need extra benefits and if the plan charges for it.

- The plan’s yearly limit on your out-of-pocket costs for all medical services.

- Whether you have Medicaid or get help from your state.

Whether you have Medicaid or get help from your state. Read the information you get from your plan

If you’re in a Medicare plan, review the “Evidence of Coverage” (EOC) and “Annual Notice of Change” (ANOC) your plan sends you each fall. The EOC gives you details about what the plan covers, how much you pay, and more. The ANOC includes any changes in coverage, costs, or service area that will be effective in January. If you don’t get these important documents, contact your plan.

Where Can I Get My Questions Answered?

Definitions

Learn More Today!

Roswell, NM Office: 110 W. Country Club Rd., Suite 5, Roswell, NM 88201

Rio Rancho, NM Office: 1453 Rio Rancho Dr SE, Suite 3, Rio Rancho, NM 87124

Albuquerque, NM Office: 1504 Wyoming Blvd NE, Suite A, Albuquerque, NM 87112

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.

© Med-Care Senior Insurance Solutions - All Rights Reserved